The pandemic rages on, and unemployment remains an economic lifeblood for hundreds of thousands in Wisconsin.

Yet, unemployment has also been a dangerous option for some time now, because the Department considers any claim-filing mistake to be fraudulent. When a mistake is discovered, the Department presumes the mistake was intentional, and the claimant must then explain why that mistake was actually not intentional and just an accident.

The Department considers any apology for a mistake, an admission that you lacked awareness or knowledge of the unemployment issue, or a failure to look up the relevant information in the claimant handbook or the Department website as an admission of guilt. Despite the statutory requirement that unemployment concealment (aka fraud) must still be intentional Wis. Stat. § 108.04(11)(g)(1), the Department mandates that claimants have “a duty of care to provide an accurate and complete response to each inquiry made by the department in connection with his or her receipt of benefits” Wis. Stat. § 108.04(11)(g)(2).

By this same law, Wisconsin does not allow physical or mental disabilities to excuse a claim-filing mistake (unless the claimant has provided specific notice to the Department of that disability in some not yet provided mechanism) while also mandating that claimants have a responsibility to read all information the Department makes available on its website or during the on-line only claims-filing process. Id. In this way, Wisconsin uses one part of state statutes to over-ride another part — that the mistake be intentional in the first place — in order to charge concealment with almost every claim-filing mistake made.

Note: In 2016, the Department re-wrote this section of unemployment law to reflect its practices in pursuing concealment. The Department, however, failed to remove the requirement that concealment still be an intentional act. So, notwithstanding its other changes, a factual finding of intent to defraud is still needed for a charge of unemployment concealment. Domingo Ramos, UI Hearing Nos. 16606402MW and 16606403MW (23 Feb. 2017) (applying new concealment definition, Commission finds that claimant’s job search mistakes were not intentional and so not concealment).

This blog is full of stories, decisions by the Labor and Industry Review Commission, and even reports on how the Department has turned claim-filing mistakes into strict liability for the purposes of charging concealment.

And, here is an expert report, describing how misunderstandings over who is the liable employer or over confusion over misleading questions establish by law that the claim-filing mistakes are unintentional.

And, here is a run-down of the numerous reasons for why concealment should not be found and which the Department has ignored and continues to ignore.

In other words, it is obvious that the Department is NOT following its own law in charging concealment as zealously and as much as it has been doing. The Department ignores this law, moreover, because it can. Claimants have to appeal the initial determinations that charge concealment, and then usually appeal decisions of an administrative law judge who follows Department guidance rather than the law on this issue.

Note: Not surprisingly, African-Americans in Wisconsin have faced the worst consequences of this concealment putsch.

One person I know of failed to report a yoga class she taught on her weekly claims after being laid off from her regular job. She was paid for those yoga class six months after teaching them: $30 a class for 12 classes. So, when she was paid she then contacted the Department about what she should do. The Department charged her with concealment because she failed to report her yoga class wages when she earned them, even though reporting wages when received is NOT fraudulent. Waoh-Tobin v. Banana Republic, UI Hearing No. 16602900MW (18 October 2016).

The kicker is that her failure to report that $30 in wages from teaching a yoga class was inconsequential to her unemployment claim. Under Wisconsin’s partial benefits calculator, the first $30 in wages is NOT counted against the unemployment benefits you receive. So, her mistake literally had zero impact on her weekly unemployment benefits.

But, because the Department charged concealment, she had to pay back her entire weekly benefit amount of $315 a week for 11 weeks (she received no unemployment benefits during her waiting week), plus a 40% administrative penalty, plus a forfeiture of future unemployment benefits — a benefit amount reduction — of $630 a week for 12 weeks. In other words, a $30 mistake for 12 weeks ($360 in toto) that has no actual affect on her weekly benefits, for the purposes of concealment, leads to:

$3,465 concealment penalty

$1,386 administrative penalty

$7,560 forfieture of future unemployment =

$12,411 she needed to repay

Why would the Department do all of this? Well, besides making unemployment more difficult, the Department now gets to pocket some of the money it collects. The 40% administrative penalty is actually two separate penalties: a 15% penalty that goes back into the unemployment trust fund and a 25% penalty that goes into a separate program integrity fund. As of September 2020, the Department had $15,115,000 in its program integrity coffer (line 228), slightly down from the $15,539,000 in the program integrity coffer in September 2019.

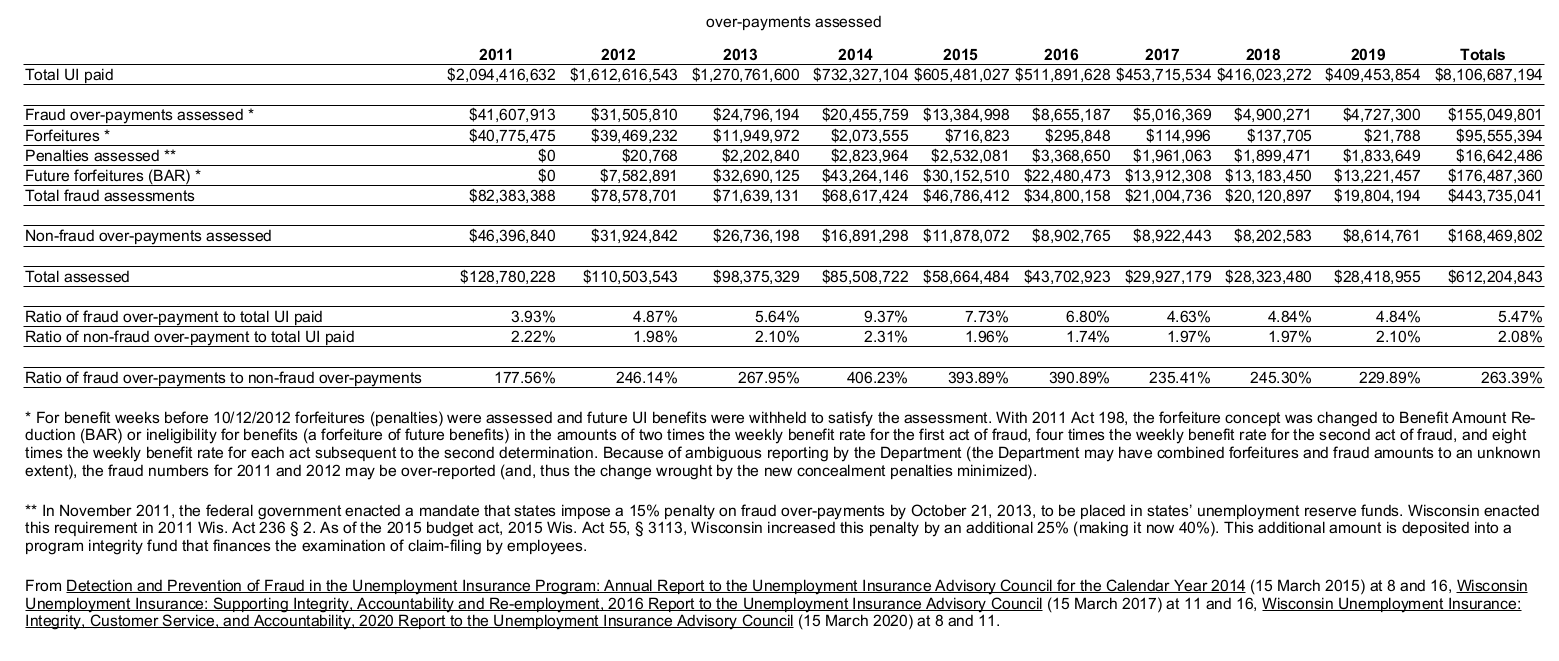

But, the combination of all of these penalties is the real story. Here is a table of the amounts the Department has assessed for concealment (based on the Department’s annual fraud reports).

As a percentage of the unemployment benefits being paid out, concealment has become a significant portion of those benefits. Non-fraud over-payments have been around 2% of unemployment benefits paid out for the years 2011 thru 2019. But, over-payments connected to fraud significantly jumped in 2013 when new penalties were introduced and were 9.37% of all benefits paid out in 2014. It is no wonder that the fraud over-payments assessed declined over time after 2014, as folks caught in the concealment trap for their claim-filing mistakes probably stopped filing claims altogether.

Note: After 2015, the Department started using all debt collection tools at its disposal, including levies of bank accounts, liens on cars and real estate, intercept of tax refunds, and even wage garnishments. In late 2018, the Department also reversed the order of how it collected from unemployment benefits. Previously, the Department only applied a benefit amount reduction to unemployment benefits after the concealment and administrative penalties were completely repaid. Now, the Department applies the benefit amount reduction to unemployment benefits first, because it can only collect that over-payment through unemployment benefits. The concealment and administrative penalties can be collected through all other available mechanisms, even when the claimant avoids filing for unemployment benefits.

Incredibly, all the fraud charging did little over time to actually curb fraud or even prevent or discourage mistakes. The percentage of non-fraud over-payments to benefits paid out has remained relatively consistent during these years: from a high of 2.22% in 2011 to a low of 1,74% in 2016. As such, it appears that mistakes are relatively constant even as the claim-filing process has undergone major changes (from being a phone and in-person system in 2011 to an on-line only system starting in 2017). So, it appears that “fraud” is largely a product of Department discretion rather than any actual description of claimants intentionally filing false unemployment claims.

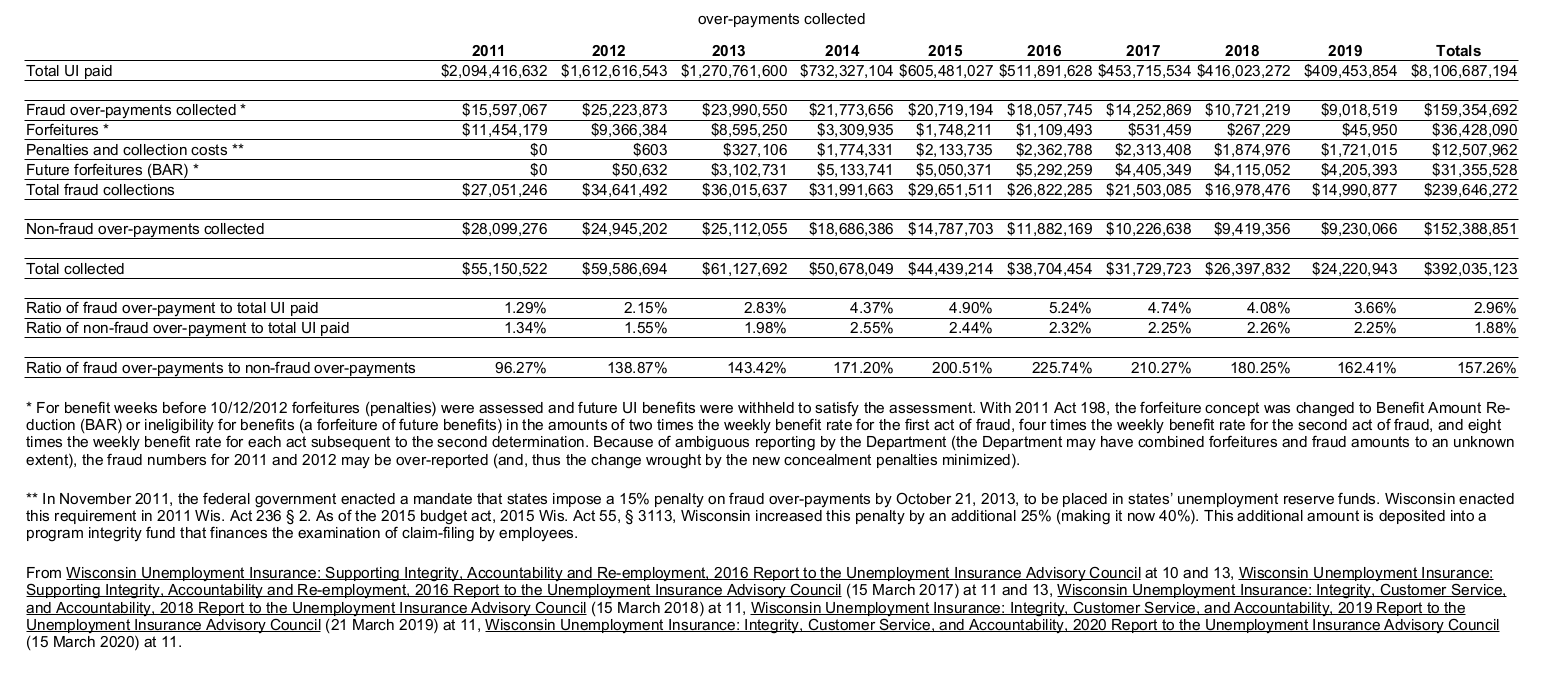

Data on unemployment collections indicates how successfully the Department has “recovered” these amounts from claimants. Collections for fraud as a percentage of benefits paid out jumped to over 2% in 2012, approached 3% in 2013, and was over 4% thereafter (hitting 5.24% in 2016) until 2019, when it dropped to just 3.66%.

The ratio of fraud to non-fraud over-payments was roughly 1-to-1 in 2011, but then began climbing and was more than 2-to-1 in 2015, 2016, and 2017. Hence, “fraud” collections increased and remained high even as the benefits being paid out plummeted. Furthermore, the penalties and collection costs going to the Department only declined slightly after 2016 (an increase from 2015 even as benefits paid declined by nearly $100 million) and was still at $1.7 million in 2019.

These numbers reveal that the Department in its discretion charges fraud to keep its own coffers filled. Like a police officer who is ordered to issue so many speeding tickets a day, the Department is now charging fraud as a departmental imperative rather than trying to assist claimants to make the claim-filing system easier to use.

Note: The toxic icing on the cake for the claimant charged with concealment for not reporting her yoga class wages was the additional hurdle that came with the pandemic: being denied her $600 PUC benefit because the Department considers a benefit amount reduction to not be a forfeiture of unemployment benefits. In this way, the Department prolongs the pain of its concealment prosecution while also undercutting the whole point with pandemic unemployment relief of keeping the economy afloat.

As of October 5th, the Department reports that 937,378 initial claims have led to 527,897 claimants receiving $3,862,512,543 in PUC, PEUC, PUA, and regular unemployment benefits. That $3.8+ billion already dwarfs the nearly $2.1 billion that was paid out in 2011 for 445,538 claimants for the entire year.

Note: Here is some historical data from the last recession (from an early 2014 financial report to the Unemployment Insurance Advisory Council):

Year Claimants $ Paid

2007 332,982 908,240,298 (only regular UI)

2008 386,574 1,243,700,322 (regular UI and start of EUC benefits)

2009 566,353 3,166,852,114 (regular UI and EUC)

2010 530,886 3,118,412,271 (regular UI and EUC)

2011 445,538 2,076,607,917 (regular UI and EUC)

2012 366,829 1,571,815,129 (regular UI and EUC)

2013 312,325 1,283,637,389 (regular UI and EUC)

. . .

2018 130,710 ~372,300,000 (regular UI)

2019 129,888 ~375,900,000 (regular UI)

With the pandemic and the now hundreds of thousands of new claimants and billions of dollars available for the taking, I fear that the Department is licking its chops in anticipation of how much it can recoup from these unsuspecting folks.

Update (15 Oct. 2020): Thanks to a financial report today and a January financial report, I now have 2018 and 2019 data on how many claimants received unemployment benefits. In these years, the number of claimants and the amount received was around one-third of what existed in 2007. Wow.

In other words, from 2007 to 2018 the unemployment system has changed so much in the intervening years that the number of people managing to receive unemployment benefits and the amount of benefits entering the state economy had been cut by two-thirds.

Now, the unemployment system is supposed to respond to a pandemic-driven economic crisis. Yet, as of the October financial report and the Oct. 13 press release, of the 952,108 initial claims filed, only 546,875 have received regular unemployment benefits totaling $1,229.9 million. This data means that over 400,000 initial claims have NOT been paid.

And, in case you were wondering: the trust fund balance as October 1st is around $1.26 billion.

Update (4 Jan. 2021): Added an image for the post. And, Fox6 has an excellent story and a podcast describing how the Department charges fraud for accidental claim-filing mistakes.