At the 19 January 2017 meeting of the Unemployment Insurance Advisory Council, the Depatment introduced nine proposals. At the 16 March 2017 Advisory Council meeting, the Department introduced a tenth proposal. Here is a rundown of those proposals and their current status as of 23 May 2017.

This provision will allow the Department to charge any benefits paid out in concealment cases to employers who do not provide wage information to the Department rather than charging the allegedly concealed unemployment benefits in question to the balancing account. The problem the Department is trying to address is that employers who are not being charged for unemployment benefits being paid out do not have a financial incentive to respond to Department inquiries.

For example, an employee gets laid from her full-time factory job. After a few weeks, she lands a part-time gig waiting tables on weekends at a banquet/wedding establishment. The employee makes a mistake about reporting her part-time tip income from the banquet employer, however. A year later, that employer does not respond to the Department’s inquiries for that tip income. The Department charges concealment against the employee anyway, and the employee does not appeal the determination for some reason (for example, she never received the concealment determination). Under this proposal, the banquet employer will now have the concealment over-payment lodged against its unemployment account, even though this employee never collected any unemployment benefits from that employer’s account.

As the February 16th meeting of the Advisory Council, the Department revised the proposal so that employers failing to provide the requested wage information would be fined $100 and those fines would be used for program integrity. As the Department explains, this additional funding would provide the Department with more than $100,000 for additional “concealment” prosecutions (footnotes omitted):

Based on 2016 data, there were 5,038 work and wage determinations with an overpayment due to concealment that were detected from a cross match or by the agency. These were chosen as these investigations rely heavily on employer information for the determination to be accurate. According to subject matter experts within the Benefit Operations Bureau, approximately 20% of work and wage information verification forms are not received or are incomplete. That results in approximately 1,007 work and wage concealment determinations made annually when employers fail to respond or fail to provide complete information. A total of 1,007 determinations with a $100 civil penalty would result in up to $100,700 annually in recouped penalties that would flow to the UI Program Integrity Fund.

At the 11 May 2017 Advisory Council meeting, the Department made the surprise announcement that IT changes would be needed to address the council’s questions and concerns (there was no description provided about what those questions and concerns were) and that the proposal was being withdrawn until the Department could implement the needed IT changes necessary for this proposal.

The Department memo explains the problem being addressed here (footnotes omitted):

Individuals who receive long-term support services in their home through government-funded care programs are domestic employers under Wisconsin’s unemployment insurance law. These employers receive financial services from fiscal agents, who directly receive and disperse government program funds. The fiscal agent is responsible for reporting employees who provide services for the domestic employers to the Department, and for paying unemployment tax liability on behalf of the employer. Currently, approximately 16,000 of the 19,000 domestic employers in Wisconsin receive government-funded care and use a fiscal agent. These employers incur tax liability when fiscal agents fail to file quarterly reports or fail to make tax liability payments. It is difficult to collect delinquent tax from domestic employers who use fiscal agents because these employers are typically collection-proof.

The goal here is to make the fiscal agents liable for the unemployment taxes at issue.

Because elder care services are statutorily distinct in Wisconsin from child care services connected to special needs or special education, it is not clear whether this proposal encompasses both programs. Also, while the proposal only speaks about government-funded care, much care (especially elder care) is paid for through fiscal agents without any government funds (many who have or are caring for elderly parents do so without government assistance at least initially). So, the proposal could be much more significant than originally framed.

It is also not all that clear what this proposal actually accomplishes. The Commission has explained that, before the question of employee status can be addressed, the issue of which employing unit (and hence employer) for which the services at issue are being provided must be examined.

This said, the commission would emphasize that as a general matter, an issue of whether a claimant provides certain services as an “employee” should not be resolved — indeed, often can not be resolved — without first deciding, expressly, what employing unit the claimant provides those services “for” within the meaning of Wis. Stat. § 108.02(12)(a). For the reasons discussed above, this is just as true in a § 108.09 claimant benefit entitlement case as it is in a § 108.10 employer tax liability case.

Dexter-Dailey v. Independent Disability Services Inc, UI Hearing No. 07002206JV (2 November 2007) (finding in the unique circumstances of this case that an individual’s status as an employee could be determined without first considering who the employer in question was); see also Community Partnerships Inc., UI Hearing No. S0600013MD (22 February 2008) (while caregivers were undeniably providing services “for” the individual clients and their families, these caregivers were also providing services “for” the named employer by discharging its obligation to see to it that these services were provided).

In County of Door, the Commission examined at length the circumstances of support services being offered to a disabled individual through a county program and discussed numerous cases that all indicated the county and not the disabled individual was the employer of record.

These decisions are persuasive. While the specific programs under which the funds originated and the care was provided were somewhat different in these cases than in the case of Hoosier and Paul [the claimants], the general principles are the same. These cases establish that, notwithstanding that a disabled person derives a benefit from care being provided to them under the auspices of a county program, it is appropriate to conclude that in such cases the services are being provided “for” the county — which bears the responsibility for seeing to it that such care is provided, and which arranges for and oversees the provision of such care. Here, as in the cases just discussed, the County benefited from the services being provided by Hoosier and Paul, in that pursuant to its application for the BIW funds, the County had assumed an obligation to see to Susan’s care. The care provided by Hoosier and Paul to Susan met the County’s obligation.

County of Door, UI Hearing No. S0500025AP (28 March 2007). Given this complexity in how the services are being provided, joint and several liability may only serve as a band-aid to the much more complicated problem of getting fiscal agents to comply with their legal requirements and making those using those services aware of what is actually going on legally about employment coverage. As the Commission noted in Community Partnerships Inc.:

That is precisely the reason that the “fiscal agent” provisions were created. In the absence of such provisions, the disabled individual (or their legal guardian), would bear the burden of having to handle all of the normal responsibilities of a UI-covered employer, including filing required reports and remitting required contributions on the “payroll” paid to the caregiver, and dealing with investigations and hearings on appeals. What §§ 46.27(5)(i) and 47.035 allow is for a social service agency to take over that administrative role, which disabled individuals (and their guardians and or family members) are ill-equipped to handle. What § 108.02(13)(k) in turns allows is for this to happen without the social service agency thereby being considered to be the actual “employer”.

So, the real problem at issue is that the fiscal agents in question are not actually performing their responsibilities as fiscal agents for their clientele, i.e., paying the unemployment taxes that are due.

The council approved of this measure at the April 20th meeting.

The Department memo provides a good explanation of what this proposal seeks to accomplish (footnotes omitted).

Under current law, employing units are required to maintain work records and must allow the Department to audit those records. When the Department intends to audit an employer, it sends a written notice to the employer requesting information regarding the employer’s employment records. If the employer does not respond, the Department issues a second written request to the employer. If the employer fails to respond to the second written request, the Department issues a subpoena to the employer. When the Department issues a subpoena, the Department must pay a fee to have the subpoena served.

About 40% of employers served with subpoenas provide an inadequate response or fail to respond to the subpoena. When an employer fails to comply with a subpoena, the Department’s remedy is enforce the subpoena in Circuit Court requesting that the employer be held in contempt. This is a time-consuming process that the Department has not historically used.

The Department proposes to change the law to assess an administrative penalty of $500.00 for a person’s failure to produce subpoenaed records to the Department. The Department will rescind the penalty if the employer fully complies with the subpoena within 20 calendar days of the issuance of the penalty. The intent of this proposal is to ensure employer compliance with requests for wage data.

This proposal expands the zero eligibility for concealment that presently takes place when wages are not reported to any failure to report vacation or holiday pay. Charles O’Neill v. Riteway Bus Service Inc., UI Hearing No. 15600518MW and 15600519MW (16 May 2015) at n.4 explains:

Vacation pay and holiday pay are treated as “wages” for purposes of the partial benefit formula, but they are not wages. See Wis. Stat. § 108.05(3); UID-M 13-26, issued Dec. 6, 2013, and revised Dec. 9, 2013. If a claimant conceals vacation or holiday pay, it is considered concealment of a material fact under Wis. Stat. § 108.04(11)(a), and the partial wage formula applies. Concealment of wages, on the other hand, falls under Wis. Stat. § 108.04(11)(b). If a claimant conceals wages in any given week, the claimant is ineligible to receive any benefits for that week.

The Advisory Council approved of this measure at the April 20th meeting.

This proposal is similar to one the Advisory Council previously rejected, D12-08, at the 1 April 2013 council meeting. In this version, the Department explains (footnote omitted):

The department may request information from unemployment benefit claimants in order to ensure that they are eligible for benefits. Under current law, a claimant is ineligible for benefits for the week in which the claimant fails to answer the department’s eligibility questions, and any subsequent weeks, until the claimant responds. A claimant who later answers the department’s eligibility questions is retroactively eligible for benefits beginning with the week in which they failed to answer the questions, if otherwise eligible.

The department proposes to amend the law to provide that claimants who fail to answer eligibility questions are ineligible beginning with the week involving the eligibility issue, not the week in which the claimant fails to answer the department’s questions. This proposed amendment clarifies that, if the department questions a claimant’s eligibility, the department will hold the claimant’s benefits until the claimant responds in order to reduce improper payments.

The council approved of this measure at the April 20th meeting. This proposal may conflict with the holding in California Department of Human Resources Development v. Java, 402 U.S. 121, 91 S.Ct. 1347, 28 L.Ed.2d 666 (1971) that unemployment benefits be paid “promptly.” See also UIPL-1145 (12 Nov. 1971) (“Determinations on issues arising in connection with new claims may be considered on time within the meaning of the Court’s requirement for promptness if accomplished no later than the second week after the week in which the claim is effective.”) and UIPL No. 04-01 (27 Oct. 2000) (similar).

This proposal seeks to make preponderance of the evidence the burden of proof for all unemployment cases. At present, claimant concealment cases require that the concealment at issue be proven by clear and convincing evidence. See, e.g., Holloway v. Mahler Enterprises Inc., UI Hearing No. 11606291MW (4 Nov. 2011). This proposal would undo the holdings in these cases as well as in misconduct cases involving theft. See, e.g., Kircher v. Stinger Tackle, UI Hearing No. 92201671RH (24 June 1994). Cases concerning whether an employer’s failure to pay unemployment taxes was willful or not would also be affected. See. e.g., Henry A. Warner, UI Hearing No. S9100679MW (16 July 1993) (clear and convincing evidence needed for showing the kind of fraudulent conduct at issue for a willful failure to pay unemployment taxes).

The only rationale provided by the Department is that Minnesota has a universal standard of proof in its unemployment cases. The Department fails to note that numerous other states do NOT have a universal burden of proof in their unemployment cases. The proposal also does not deal with Wisconsin court decisions that hold that fraud must be proven by clear and convincing evidence, a higher degree of proof than in ordinary civil cases. Kamuchey v. Trzesniewski, 8 Wis.2d 94, 98, 98 N.W.2d 403 (1959), citing Schroeder v. Drees, 1 Wis.2d 106, 83 N.W.2d 707 (1957), Eiden v. Hovde, 260 Wis. 573, 51 N.W.2d 531 (1952). As the Wisconsin Supreme Court explained in Wangen v. Ford Motor Co., 97 Wis.2d 260, 299-300, 294 N.W.2d 437 (1980):

This court has required a higher burden of proof, i.e., to a reasonable certainty by evidence that is clear, satisfactory and convincing (Wis. J.I. — Civil Nos. 205 and 210), “[i]n the class of cases involving fraud, of which undue influence is a specie, gross negligence, and civil actions involving criminal acts.” Kuehn v. Kuehn, 11 Wis.2d 15, 26, 104 N.W.2d 138 (1960). See, e.g., Klipstein v. Raschein, 117 Wis. 248, 253, 94 N.W. 63 (1903) (whether fraud occurred); Lang v. Oudenhoven, 213 Wis. 666, 668, 252 N.W. 167 (1934) (whether moral turpitude existed in cases of fraud); Martell v. Klingman, 11 Wis.2d 296, 310-311, 105 N.W.2d 446 (1960) (whether gross negligence existed); Comment to Wis. J.I. — Civil No. 2401, Misrepresentation: Intentional Deceit (whether intentional deceit occurred); and Poertner v. Poertner, 66 Wis. 644, 647, 29 N.W. 386 (1886) (factual issue of adultery in divorce action). This burden of proof, referred to as the middle burden of proof, requires a greater degree of certitude than that required in ordinary civil cases but a lesser degree than that required to convict in a criminal case.

NOTE: there are generally three standards for the burden of proof in legal matters: preponderance of the evidence, clear and convincing, and beyond a reasonable doubt.

This proposal seeks to make numerous changes to the Department’s collection efforts.

- Attempts to undo a recent holding in Wisconsin bankruptcy court, In re Beck (Bankr. E.D. Wis., 2016), that the personal unemployment debts of claimants are not to be treated as “secured” debts for bankruptcy purposes. Under this decision, unemployment debts can be discharged or written off and considered un-collectable, unlike employer debts. The Department wants to reverse that result by rewriting how claimant over-payments are described in state law. The proposal seeks to accomplish this change by removing references to employer, employing units, and s.108.10 and thereby making unemployment collection provisions generic to any and all “persons.”

- Increasing the penalty for third-parties who do not cooperate with the Department’s collection efforts (such as employers for wage garnishment or banks for account liens) to 50% of the amount at issue and adding those penalty amounts to the Department’s “program integrity” fund.

- Removing the 20% threshold for personal liability for an employer’s unpaid unemployment taxes.

- Expand the scope of state payments eligible for an intercept to satisfy delinquent employer taxes. Currently, these intercepts only occur for claimant over-payments.

A May 23rd revision to this proposal included new language on pp.6 and 8 so that liens can be recorded even when an appeal is pending and indicated on p.10 that the Department would provide ten days notice for any warrants or liens it was seeking (in essence, codifying the Department’s current practice)

The Advisory Council approved of this measure at the 23 May 2017 meeting with one change: the ten day notice for warrants and liens would instead be fifteen days notice.

This catchall proposal contains numerous technical changes. The Advisory Council approved this proposal at the 23 May 2017 meeting.

Noticeably, this proposal is the first which provides some fiscal numbers on the number of positions to be funded from the Department’s program integrity slush fund that are outside of the state’s normal biennial budget:

In the schedule under section 20.005 (3) of the statutes for the appropriation to the department of workforce development under section 20.445 (1) (v) of the statutes, as affected by the acts of 2017, the dollar amount is increased by $1,630,000 for the first fiscal year of the fiscal biennium in which this subsection takes effect for the purpose of increasing the authorized FTE positions for the department of workforce development by 5.0 SEG positions annually and providing additional funding for the purpose of conducting program integrity activities, investigating concealment, and investigating worker misclassification. In the schedule under section 20.005 (3) of the statutes for the appropriation to the department of workforce development under section 20.445 (1) (v) of the statutes, as affected by the acts of 2017, the dollar amount is increased by $1,630,000 for the second fiscal year of the fiscal biennium in which this subsection takes effect for the purpose of increasing the authorized FTE positions for the department of workforce development by 5.0 SEG positions annually and providing additional funding for the purpose of conducting program integrity activities, investigating concealment, and investigating worker misclassification.

The Advisory Council gave its go-ahead for this proposal on May 23rd.

This proposal is a catch-all of various rule changes. The Department did not provide actual language of the proposed changes. Perhaps the most significant change here is that the wait-time for unemployment hearings will be ten minutes for all parties (at present, the appealing party has fifteen minutes to arrive before the hearing is closed, while the non-appealing party has five minutes to arrive late before the hearing starts). That is, under this new rule, an appealing party will need to arrive for a hearing set to start at 10:30am no later than 10:40am before that hearing will be closed and dismissed because the appealing party failed to appear.

The council approved of this measure at the March 16th meeting. As a result, the scope statement is now available.

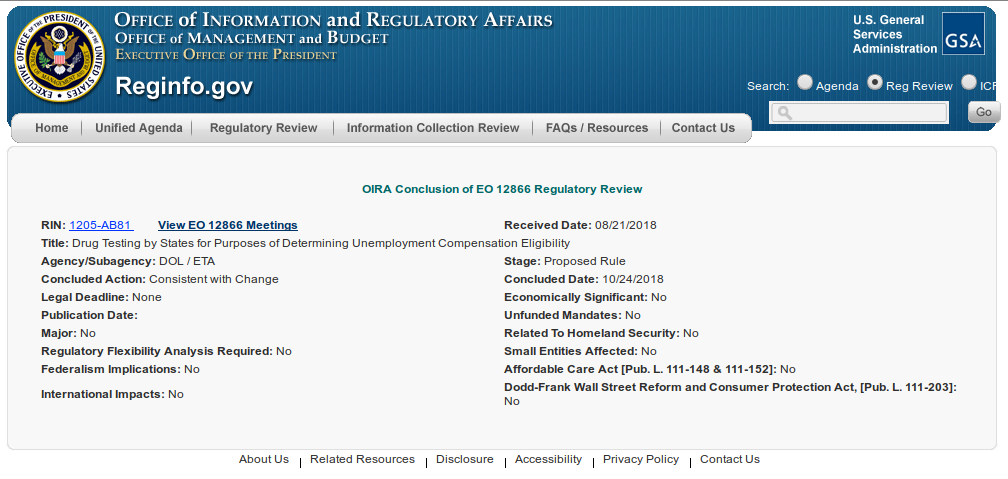

Voluntary reporting by employers of either positive drug test results by job applicants or the applicants’ refusal to take a drug test has not been happening. And so, the Department has proposed various changes to make this voluntary reporting by employers more palatable.

The proposal cleans up some of the statutory language from the original drug-testing provisions. It also adds some options for how the Department will apply occupational drug-testing (when federal rules are finally put into place), reinforces the confidentiality of the drug testing at issue, and attempts to immunize employers from liability for reporting applicants’ drug test results.

NOTE: the liability immunization is more talk than substance, as federal ERISA and HIPAA laws that govern self-insured employers will preempt any and all state laws.

Finally, to take advantage of unspent funds, the Department proposes that leftover monies for drug testing and treatment be transferred to the Department’s program integrity efforts. So, the $500,000 slated for testing and treatment in FY2017 will be added to the Department’s mushrooming slush fund for finding claimant mistakes and charging them with concealment.

The council approved of this measure at the April 20th meeting.