The claim-filing process in Wisconsin is a complete and confusing mystery to most. Here is an explanation of the legal mechanics and process of an unemployment claim.

This explanation applies regardless of the type of claim filed (regular unemployment, PUA, PEUC, EB — whatever). Where differences arise and I am aware of those differences, they will be noted.

This primer covers the following topics:

- initial claims

- weekly claims or weekly certifications

- monetary eligibility — aka, your benefit year calculation

- non-monetary eligibility — initial determinations relating to a job separation, not being able and available, failing to satisfy a Department job search requirement, or failing to satisfy some other Department claim-filing requirement

- Partial eligibility — reporting on your weekly certifications your part-time work while collecting unemployment benefits

- unemployment fraud/concealment

- benefit over-payments, offsets, and collections: how to object or appeal

- unemployment hearings — the appeal, appeal confirmation, hearing packet (for telephone hearings), hearing notice, and hearing/appeal tribunal decision

- petitions for Commission review

These are the actual documents that you MUST pay attention to. Many of these documents do NOT ever appear on your portal (e.g., benefit year calculations and appeal tribunal decisions) and at times do even match what is displayed on your portal. What the UI portal presents is generally NOT relevant to your unemployment claim unless you have an intimate understanding of internal Department processes and procedures. It is the documents mentioned here — initial determinations and benefit year calculations and the like — which are relevant and which DO matter. So, do not look at the portal for information relating to your unemployment claim and instead pay attention to these documents and what they mean.

Also, you need to understand and start tracking the initial determinations and appeal tribunal decisions (decisions issued by administrative law judges) by the numbers on those documents. It is easy to get confused with how the Department issues documents and refers to those documents without any numbers. But, the legal status of your unemployment claim turns on these documents and the numbers connected to those documents. So, you need to follow the numbers on various documents like initial determinations and appeal tribunal decisions, just as the Department does internally.

An initial claim

All unemployment claims start with the initial claim that lays out your job history and the reason you are filing your unemployment claim at this point in time.

The initial claim process in Wisconsin is incredibly complex and will ask for specific dates for when you started and ended jobs as well as the reasons why those jobs ended.

Before filing an initial claim, look over the questions you will be asked and read through the Workers’ Guide to Unemployment Law about how to answer questions concerning your job separation and other matters. You will need to provide your work history going as far back possibly as two years, so get all of those details at your ready before starting. Exact dates are vital, so get all dates about when you first started working a job and last worked a job down on paper, going back 18 months from the date of your unemployment claim and covering every job you have had during those past 18 months. Expect the process to take around two hours if you have all of your information, longer if you do not.

Note: And, to understand all that is being asked of you in this process, expect to spend a day or more going through this primer and other claim-filing information as well as the Workers’ Guide to Unemployment Law. The Department requires you to understand the questions being asked of you as if you are a lawyer who knows unemployment law inside and out. Understandably, that expectation of claimants is ridiculous, but it is what the Department currently expects of claimants when answering these questions. So, take your time, and ask questions of Department staffers about anything you have concerns with by calling the Department’s help lines. Take notes of those conversations and track the dates of when you speak to those staffers, as those notes may be useful six or twelve months later at an unemployment hearing about why you answered a question a certain way.

In general, the more information you provide means there are more reasons to deny your claim. Department adjudicators are NOT looking to make a holistic examination of why you should receive unemployment benefit but instead are looking for any possible reason to deny your claim. So, provide basic explanations only.

In general, you should file your initial claim within ten days of any job separation for which you want to claim unemployment benefits. If you delay filing for any reason, you likely will not be paid for missing weeks and you may well be declared ineligible because your claim is too late or you may lack sufficient benefit year earnings to establish a benefit year (discussed below).

Note: There is a provision for allowing a late initial claim to be back-dated, but the Department has in general made it all but impossible for that back-dating to happen. An initial claim for PUA benefits under the Continued Assistance Act can only be back-dated to 1 December 2020. An initial claim for PUA benefits which was filed before 27 December 2020 can be backdated to your pandemic-related job loss as early as 2/2/2020.

The initial claim triggers an investigation and determination by the Department into whether you have sufficient earnings to establish a benefit year, what in UI-speak is called monetary eligibility.

So, the first hurdle with regular unemployment eligibility is your monetary eligibility.

Note: At the end of filing your initial claim, you will be offered the chance to create a PDF of that claim for your records. DO SO. The Department may change your initial claim information based on how the Department later handles it. You want a record of what you initially filed so that you know how you originally answered or did not answer the questions asked of you.

Weekly claims/certifications

An initial claim does NOT get you paid unemployment benefits for any particular week. To receive any kind of unemployment benefit you need to file a weekly claim or a weekly certification for each week you want to receive unemployment benefits.

As with the initial claim, the weekly certification process has also become incredibly complex, going from 11 questions in 2007 to 120+ questions today.

So, before filing a weekly certification, look over the questions you will be asked and read through the Workers’ Guide to Unemployment Law about how to answer questions concerning any job separations and other matters. Read this primer beforehand about all the job search issues that are asked about as well as all the able and available issues that will appear during the weekly certification.

The certification process takes several hours and requires a great deal of information. Any mistakes or information left out will mean an immediate halt of any benefits being paid, a likely denial of your claim, and a possible charge of fraud if the mistake involves misreporting wages and work, your job searches, or your able and available status.

You can skip a week when filing weekly certifications, but the on-line process for doing so is cumbersome and confusing.

If you skip two weeks or more, you will need to file a new initial claim as well as the weekly certification. The Department mandates a new initial claim because it considers a gap of two weeks or more as an indicator that there has been a new kind of job separation or some other event that might make you ineligible.

So, folks who take a two week vacation and stop filing weekly certifications while on vacation are penalized by having to file a new initial claim. And, if you do file weekly certifications but answer that you are not able and available for work (because you are on vacation), your claim will be put on hold for all further weeks until the weekly certifications during the vacation are investigated and an initial determination denying you benefits for those weeks is issued.

Note: At the end of filing your weekly certification, you will be offered the chance to create a PDF of that claim for your records. DO SO. The Department may change your weekly certification information based on how the Department later handles it. You want a record of what you originally filed so that you know how you actually answered or did not answer the questions asked of you.

Monetarily eligible

An initial claim triggers an investigation into whether a claimant is monetarily eligible for unemployment benefits. In most cases, the Department looks at the quarterly unemployment tax reports filed by employers to determine if your earnings are sufficient to create a benefit year. These quarters are:

- 1Q: January thru March

- 2Q: April thru June

- 3Q: July thru September

- 4Q: October thru December

A benefit year calculation is based on four consecutive quarters of income, and the Department will look back up to six quarters to find four possible quarters on which you will qualify for a benefit year.

Keep in that that these quarters can NOT include the quarter in which you unemployment claim starts. So, if you file an initial claim for benefits starting in March, any income earned from January through March can NOT be included in your benefit year. As already noted, the Department will, however, look back up to a year and half back to find four consecutive quarters that can establish a benefit year.

You can enter your income for these four consecutive quarters and test your potential eligibility for a benefit year at this link.

The Department will send a benefit year eligibility calculation (UCB-700/701/736 and maybe some other numbers I do not know of) that sets forth the Department’s decision. Here, here, and here are some examples.

If income or an employer is NOT listed on this form or the income numbers are wrong, you need to OBJECT — not appeal — by calling a claims specialist within 14 days of the form’s mailing at the Department’s help line and explaining why you think there is an error and backing up your explanation with pay stubs and W2 forms.

If the claims specialists refuses to believe you, you can still insist there is an error by demanding that an initial determination be issued. Once that initial determination is issued, you then need to file an appeal to have a hearing before an administrative law judge over this dispute.

At present, the benefit year calculation form is only mailed to you and does NOT appear on your portal. So, make sure to keep a copy of this form. While the portal will show your benefit year, that information will change according to how the Department changes its assessment of your claim. So, the information on this form can “disappear” from Department records without warning and be extremely difficult to recover or identify.

With the pandemic, those with insufficient earnings to qualify for a benefit year AND who have a pandemic-related job loss qualify for PUA benefits. The benefit year calculation for PUA eligibility looks like this form.

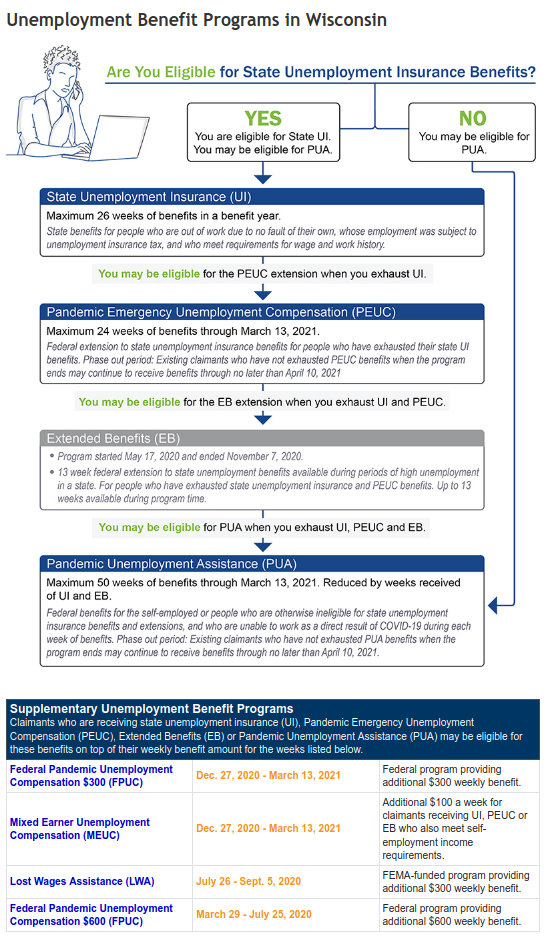

If you exhaust your benefit year for regular unemployment benefits, you may then be eligible for PEUC and EB benefits, which provide supplemental unemployment benefits during recessionary times (PEUC benefits are specific to the pandemic, while EB benefits have existed for decades).

Note: You might also be eligible for PUA benefits if your eligibility for regular unemployment benefits, PEUC, and EB benefits has been exhausted. But, that PUA eligibility also requires that you have a pandemic-related job loss. So, if there is no pandemic-related job loss when you lost your eligibility for regular unemployment, PEUC, and EB benefits, your claim for PUA benefits will fail.

The process for applying for PEUC and EB and when that happens is not at all well-explained in Wisconsin. You basically have to know yourself when you have exhausted your eligibility for regular unemployment benefits and then understand that you should then apply for additional PEUC or EB benefits. But, this progression chart recently created by Department offers splendid guidance about when eligibility for these programs occurs.

And, whenever a new quarter starts, the Department has to re-examine if you might qualify for a new benefit year for receiving regular unemployment benefits in place of your current PEUC or EB benefits. So, payment of these benefits will be delayed in April, July, October, and January when the Department does this re-examination. To address this problem, the Continued Assistance Act provided a mechanism for continuing with PEUC payments when this quarterly re-examination was done. Unfortunately, since the Department is not instituting PEUC under the Continued Assistance Act until late April 2021, claimants in Wisconsin will not see this improvement.

Non-monetary eligibility — aka the initial determination

Once monetary eligibility requirements are established (i.e., the claimant is monetarily eligible for benefits), there are numerous other hurdles that have to be overcome. In general, to be eligible for unemployment benefits a claimant needs to show that:

- there is a job loss through no fault of the claimant,

- the claimant is able and available for work, and

- the claimant is actively seeking work.

These three basic requirements, however, have become incredibly complicated over the last several years to the point where claimants have to navigate the equivalent of a mine field in order to have their claim approved. The weekly certification — now 120+ questions — is essentially about these three issues.

Note: In light of this complexity, for some time now the majority of unemployment claims in Wisconsin are denied because claimants fail to meet a Department requirement for maintaining eligibility and have nothing to do with why the claimant loss work in the first place.

When the Department denies a claim, an initial determination (UCB-20) is issued.

Refer to an initial determination by the nine-digit number in the upper left corner, as you can have multiple initial determinations as well as issues for which an initial determination has not yet been issued for any given week (confusingly, the online portal refers to initial determinations by the week at issue, and so it is easy to miss multiple and different initial determinations for any one week).

If there is any doubt in your mind whatsoever about the Department’s denial of your claim, APPEAL that initial determination. Do NOT think that the Department simply made a mistake and will later correct that mistake with new information. Once your claim is denied, the Department no longer considers you eligible. All benefit payments stop, and the Department stops investigating your eligibility. Your only chance to correct a mistaken initial determination is to appeal that initial determination.

Furthermore, do NOT withdraw that appeal even if a Department staffer tells you that you should because your appeal is holding up payment of your claim. Only when you have explicit confirmation that withdrawal of the appeal will lead to your claim being approved and paid should you allow your appeal to be withdrawn. As already noted, once your claim is denied, the Department no longer considers you eligible for anything until that denial is over-turned. So, if you withdraw your appeal, that denial remains in place.

Only in the rare circumstance where the Department acknowledges that the initial determination denying your claim was issued in error and the Department wants to correct that mistake should you allow your appeal to be withdrawn.

Note: There are other very limited circumstances where withdrawing an appeal makes sense, but those are limited to specific factual and legal cases that generally do not apply to most claimants.

When you do withdraw your appeal, a withdrawal appeal tribunal decision from an administrative law judge is issued. The bottom right corner will have an appeal date before that withdrawal decision becomes final. If you withdrew an appeal by mistake (of late, there is much bad advice from staffers encouraging claimants to withdraw appeals denying their claims under the false promise of then having benefits paid), you need to appeal that withdrawal appeal tribunal decision by writing a letter to the hearing office explaining that you want to retract the withdrawal of your appeal. Yes, that is a mouthful.

Here is a sample retraction letter. If you miss this deadline for this retraction request, you need to file a petition with the Commission. See Lexi Schroeder v. BWW Resources LLC, UI Hearing No. 20601748MW (21 Aug. 2020). Here is a sample petition for retracting an appeal withdrawal because of bad advice from the Department.

These initial determinations are mailed to you. After being mailed, they will also show up in the on-line portal under your Document History. When an initial determination is denying you benefits, it is the legal document that matters. So, hang on to it (you should also hang on to any initial determinations that approve your claim for benefits, should the Department later revisit that week and issue and deny your claim).

Separation issues

Separation issues concern whether an employee was discharged because of misconduct or substantial fault (either of which disqualifies a claimant from receiving benefits), whether an employee who quit had good cause for quitting (and is thereby eligible to receive unemployment benefits), or determining whether an employee quit or was discharged (and then, whether the discharge was for good cause or the discharge was for misconduct or substantial fault).

These issues are well-explained in the Workers’ Guide to Unemployment Law, so look there for an explanation of these issues.

And, keep in mind that, prior to the pandemic, only around 20% of the claims being denied were because of disputes between the employee and employer over the job separation.

But, because the Department is now examining all benefit year separations (separations prior to the pandemic-related layoff) that could still disqualify a claimant from receiving benefits, the number of these disqualifications has sky-rocketed of late. So, even if approved for benefits initially, the Department may still deny your claim because of a prior benefit year separation and order a repayment of all benefits received in the meantime.

Job search/registration and job offers

Traditionally, claimants indicated that they were actively seeking work by saying simply that they were actively seeking work and doing a specified number of job search actions per week.

In the 2013 state budget, the number of job search actions were increased to four per week, and over the next few years numerous limitations were added to what would qualify for a job search.

Per Bodo Viliunas, UI Hearing No. 15607525MW (4 March 2016), the following actions and only these actions count as a valid job search action:

- Applying for work with employers who have available openings (a second application to the same employer within four weeks is not allowed, unless the application is to a new, different job, the employer’s customary practices allow for multiple applications to the same job opening, or the employer is a temporary help employer).

- Taking examinations for suitable work, such as civil service or a similar kind of test, such as a WorkKeys exam.

- Registering for suitable work with a public or private placement facility, including a union.

- Mandatory Job Center of Wisconsin registration (counts as one job search action when done, but as noted below is a separate requirement that needs to be done outside of any job search requirements).

- Posting a resume on an employment website (only one posting per website is normally allowed).

- Following the recommendations of a public employment office or similar re-employment services, including participation in re-employment services.

- Attending mandatory re-employment services training (RESEA) operated by DWD (counts as one job search action when done, but as noted below is a separate requirement that needs to be done outside of these job search requirements).

- Registering with a placement facility or a head hunter.

- Meeting with a career counselor.

- Participating in a job interview.

- Participating in weekly professional networking group connected to your profession.

These job searches have to be reported as part of each weekly claim certification. Forms outside of the claim certification process for tracking your job searches as you do them are available for download at this link. The Department’s explanation of its work search requirements is available here.

Expect that your job search efforts will be audited. Prior to the pandemic, insiders at the Department informed me that, besides dedicated audit teams, all claims workers at the Department needed to review a specific number of claims each week as part of their regular job duties. In other words, the Department has made finding claimant “job search mistakes” a priority for everyone working there.

When audited, you (not the employer) will need to supply some kind of confirmation from the employer about your job application. That confirmation is best handled by keeping the e-mail message you receive from the employer or website and submitting that e-mail message to the Department as proof of your job application.

Of course, the Department will not allow you to forward that e-mail message to the Department staffer auditing your job search records. Rather, you will likely need to print the e-mail confirmation and fax or mail that message to the Department staffer. As one insider explained this auditing procedure to me: It is annoying for everyone, and there is no reason for this no e-mail policy other than claimant inconvenience.

Note: the four job searches per week, and only the four job searches per week, have been waived during the pandemic. That waiver will go away at some point, and this job search requirement will be back in place. Even with this temporary waiver, all other requirements, including the other job-search-related requirements described below, remain fully in place.

In addition, to doing four job searches a week, claimants must also register with the job center of Wisconsin website. Registration requires both creating a user-id and password and also answering a questionnaire about your job history, education, and job search goals. These questions require detailed answers, because it is through your answers to these questions that the Department will create a resume for you.

Why not upload the resume you already created? That would be too easy and so is not allowed. You must answer these questions and create your resume in the manner specified by the Department. Until you “register” this way, all unemployment benefits will be denied. The only claimants who can avoid this registration requirement are those who an employer has said will be returning to work in around four to six weeks or employees claiming partial unemployment benefits when working 16 or more hours in a week.

As Laura Hoffman, UI Hearing No.17002961MW (16 Nov. 2017) indicates, benefits will not be paid until this step is completed. The quality of the “resume” you create is not that important, so do not delay in order to get the resume done right. You can always revise the resume later.

RESEA is the acronym for a job-search training seminar that you will be required to attend if your unemployment claim goes longer than a few weeks (during the pandemic, the Department initially said these seminars would still occur in-person, then on-line and by phone, then apparently did not schedule any, and towards the end of 2020 began scheduling them in earnest). For the foreseeable, these job search seminars will all be done virtually. When told to attend, you must attend unless a job interview is scheduled for the same time (and then, you must contact the Department to re-schedule). If you miss your RESEA training, all benefits will be on denied until you complete this requirement.

If you have worked with a temp agency, you are required to contact that temp agency as one of your four job search actions for every week you claim benefits. That is, once employed at a temp agency, you have an on-going requirement on each week of your unemployment claim to continue to contact that temp agency for new assignments. See this post for the details.

If you fail to contact that temp agency about available assignments for each weekly certification you file, the temp agency can inform the Department of your lack of contact. You will then have to prove that: (a) either you actually did contact the temp agency by having phone logs or copies of e-mail messages and letters showing that contact, or (b) the temp agency failed to inform you of this requirement when you last worked for it (if this requirement is included in the small print of some notice the temp agency provided you, the Department considers you to have been informed).

If an interview or job application leads to a job offer, you probably need to accept that job offer (and, presume the employer extending the offer will report that offer to the Department should you decline to accept the job). You generally have up to six weeks from when you became unemployed in which you can turn down work without becoming ineligible for unemployment benefits when the work being turned down is: (a) a lower grade of skill, or (b) at a significantly lower rate of pay than you had during your previous jobs. This period is called your canvassing period.

After the canvassing period ends, however, you need to accept any reasonable job offers. Benninger v. Spherion Atlantic Resources LLC, UI Hearing No. 04004083MD (17 December 2004) (“a sliding scale approach has been applied to determine whether an employee had good cause to refuse an offer of work after the six-week canvassing period”). What is reasonable is in the eye of the beholder, however, so generally plan on accepting any job offers you receive after your canvassing period is over.

Any job offer presented to you must also be a bona fide job offer. That means that you have reasonable notice to accept and start the job, reasonable travel distance for this work, a mutual understanding of what the job duties are, a definite start date and time, and a set pay rate. An employer who calls you up and tells you to start working at the store in two hours is not a bona fide job offer. For examples of what is and what is not a bona fide job offer, see Schmitt v. Maxim Healthcare Services, Inc., UI Hearing No.17003132MW (31 August 2017), Kunze v. City of Stevens Point Transportation, UI Hearing No. 13003015MD, 13003016MD, 13003017MD, & 13003018MD (29 Nov. 2013), Coto Valentin v. Vici Capilli Salon, UI Hearing No. 11610281MW (27 March 2012), Bennett v. Perrines Clark Service Inc., UI Hearing No. 08602681RC (15 August 2008), and Schuele v. Cornwell Personall Associates Ltd., UI Hearing No. 03002139WK (30 Jan. 2004).

Being able and available for work, not missing work, and self-employment

In Wisconsin, you need to be able and available for full-time work for each week claimed. This requirement, however, is NOT that simple to understand or implement.

First, despite full-time work being specified as 32 or more hours of work in a week, see Wis. Stat. § 108.02(15s), full-time work is in actuality a subjective standard when workers have any mental or physical disabilities that limit the hours of work they can do per week.

DWD 128.01(3) and (4) provide that as long as an employee is open to “some substantial gainful employment, then an “individual who has a physical or psychological restriction and is found able to work under sub. (3) shall not be considered unavailable for work solely because of inability to work.” That is, as long as a person can work to what their physical and psychological limitations will allow, he or she is able and available for full-time work for the purpose of unemployment law. As explained via two examples in this regulation (emphasis supplied):

Example 1: A claimant has a number of physical restrictions due to recent surgery, including a restriction to work no more than 20 hours per week for 2 months. With the restrictions, the claimant cannot perform the duties of his or her usual occupation but is able to perform a number of jobs for which he or she has prior training and experience. The claimant is willing to do these jobs and is willing to work 20 hours per week. The claimant has no other restrictions to availability. Benefits will not be denied solely because of the inability to work full-time.

Example 2: A claimant is restricted to working 30 hours per week due to medical problems. The claimant is still able to perform the duties of his or her usual occupation. However, the claimant is unwilling to work more than 20 hours per week because the claimant is receiving Social Security benefits and more than 20 hours of work would reduce those benefits. Benefits will be denied until the claimant is available for 30 hours of work per week.

In the first example, the employee’s work is limited because a recent surgery prevents him or her from working more than 20 hours in a week. That person is still able and available for full-time work of 20 hours, even though this number is less than 32 hours in a week. In the second example, the employee is limiting hours of work because of a financial consideration to a number less than 30 rather than the 30 hours allowed by his or her disability. So, that person is NOT able and available under these regulations. If the second example person worked 30 hours a week rather than limiting him or herself by choice to only 20 hours a week, then he or she would still be able and available for purposes of unemployment law.

Note: Department investigators and administrative law judges will often ask claimants if they limit their work hours without asking why. If you fail to explain that the limitation only exists because of your physical or mental disability, then the Department staffer or administrative law judge will presume you are limiting your hours of work because of personal preference.

This attention to individual workers’ own circumstances is why being able and available for full-time work varies from individual worker to individual worker. Everyone should answer YES to this question when they can work their normal hours, as set by their physical or psychological disabilities. As long as the work is, for unemployment purposes, substantial gainful employment, then that work qualifies, whether 32 hours a week or just 12 hours a week.

The Labor and Industry Review Commission has on numerous occasions reinforced this point. See Tunisha Perkins, UI Hearing No. 11605816MW (11 Jan. 2012), Kouimelis v. Dennys Restaurant 6318, UI Hearing No. 12201489EC (4 Dec. 2012), and Wright v. Independence First Inc., UI Hearing No. 09607759MW (8 March 2010). There is no legal dispute that being able and available for full-time work depends on the individual worker’s own, specific abilities and that work restrictions based on physical or psychological disabilities are NOT disqualifying.

The Department, however, does not explain any of these issues with this question. Indeed, the Department apparently does not accept these issues as actual unemployment law, as the Department-provided explanation in this question of being able and available for full-time work simply does not square at all with the state’s unemployment law: the explanation presented when filing a weekly certification simply offers a flat out denial of eligibility to anyone who has restrictions on his or her work. As a result, many disabled folks think, because they are disabled and so restricted in their work options, that they must answer “no” to this question.

Furthermore, when Department staffers investigate these mistaken answers to this question, they ignore the regulations cited above and tell claimants that full-time work only means working 32 or more hours in a week. Even many administrative law judges will only look at this issue in this light and in complete disregard of these regulations and Commission case law (unless this law is pointed out to them).

So, disabled folks and anyone else with physical or psychological restrictions of their work should always answer “Yes” to this question about being able to work full-time. If you normally work 12 hours a week because of your disability and can still work 12 hours a week when unemployed, then for the purpose of unemployment law you are able and available for full-time work.

You also need to report any missed hours of work, see Kunze v. City of Stevens Point Transportation, UI Hearing No. 13003015MD, 13003016MD, 13003017MD, and 13003018MD (29 November 2013) (any missed shift for which due notice by the employer was provided constitutes work and wages that need to be reported on each weekly claim certification), which could include missed hours or pay because of illness, missed holiday hours and pay, and even missed vacation hours and pay as well as other kinds of possible pay and work hours. Missing a shift to take a child to a doctor’s appointment constitutes missed work that needs to be reported as if you did not miss that shift (and the missed wages will be deducted from your weekly benefit). Moreover, as noted below, if paid for this missed work, you need to report that pay in the proper category, even while still noting that the work was missed.

Self-employment generally does not affect your eligibility for regular unemployment benefits. But, claimants still need to report their self-employment earnings (which are NOT offset against a person’s unemployment benefit) and hours worked in self-employment. The self-employment wages issue is discussed below with partial eligibility. Hours worked in self-employment need to be reported because: per Wis. Stat. § 108.04(1)(b), if you work 16 or more hours in self-employment, the Department considers that self-employed person no longer available for work and then that person is ineligible for all regular unemployment benefits. This eligibility ban, however, is NOT explained in any Department materials.

Partial eligibility

Wisconsin has a generous partial wage formula that allows many claimants to continue to receive unemployment benefits even when working a great deal. The formula is to take the wages earned in a week, minus $30 from those wages, then multiply by 2/3, and then subtract that new amount from the claimant’s Weekly Benefit Rate (“WBR”) to get the partial benefit received for the week.

For example, a claimant with a WBR of $300 who earns $360 in wages that week will still receive $80 in unemployment benefits on top of that $360 in wages.

$360 - 30 = $330

$330 X 2/3 = $220

$300 - $220 = $80.00 in unemployment benefits for the week

The partial benefits calculator will do the math automatically.

The trick is to report all wages earned in a week without any mistakes, because any mistake about wage reporting will likely mean a charge of fraud. So, as a claimant you need to report any and all wages earned in a week before being paid those wages and in the proper income category. If the employer reports a different number, you are in trouble. And, if the Department does not find out about a reporting discrepancy between you and your employer until the employer files quarterly tax reports, you will definitely be charged with fraud.

Note: even a failure to report $30 or less in weekly earnings — an amount that will have no effect on your weekly unemployment benefit — will still lead to a charge of fraud by the Department. For why, see this post.

So, wages of any kind from any employer need to be reported. Because unemployment benefits are based on a benefit year and can include any and all employers in that benefit year, you do not claim unemployment benefits against a particular employer. Many claimants in Wisconsin think that when filing a claim they are claiming benefits from their last employer, the employer from whom they were separated and which led to their unemployment claim in the first place. As a result, they think they do not need to report any wages they have from other employers because those other wages are not being “claimed” by them.

This idea of only claiming benefits from the one employer that is responsible for your unemployment claim — i.e., the job separation employer — is a mistake. The job separation employer, however, is just that, nothing more, and no employee claims benefits from that one employer when filing weekly certifications. Rather, you claim your unemployment benefits based on your benefit year earnings that established your monetary eligibility, regardless of whether your benefit year has one employer or a dozen employers.

Again, the unemployment benefits being received are based on your benefit year earnings and are a different issue completely from the job separation issue with your last employer that led to your unemployment claim. And, because you can establish a new benefit year with any subsequent earnings, you need to report any and all earnings in covered employment when those wages are earned, even if those wages are not paid until weeks or even months later.

So, there are many, many legal things to track when reporting your wages. Covered employment is one. Self-employment wages are NOT offset against your unemployment benefits (Wisconsin may be the only state that does not offset self-employment wages from your unemployment benefits) because you are neither an employee for someone else when self-employed and the work being done is not covered employment. So, self-employment income as well as hours worked in self-employment (discussed above) are reported separately and the wages NOT offset against your unemployment benefits. Even if you receive $2000 in self-employment and your weekly benefit rate is $150, you still receive $150 in unemployment benefits the week you receive that $2000 in self-employment.

Note: Under unemployment law, establishing self-employment (aka, being an independent contractor) is incredibly difficult. For the most part, most people who think they are self-employed are actually NOT self-employed for purposes of unemployment law. The Department routinely considers reporting income as self-employment income rather than as wage income is fraudulent, so make sure you are truly self-employed when reporting any income and hours as self-employment.

All other kinds of income need to be reported as well if that income is received because of services you provide to someone else. Each kind of income needs to be reported in the category for which the Department believes it belongs. Any mistaken reporting will likely lead to a charge of unemployment fraud or concealment, regardless of whether the total amount in question is correctly reported. The Department wants you to report PTO pay and hours. And, you need to report sick time and pay, vacation time and pay, holiday time and pay, performance bonuses, disability and insurance benefit payments and the work-time included in such payments, and termination or dismissal pay of any kind. Any, any other kind of pay needs to be reported in the category the Department considers correct, not what you or the employer consider to be correct. So, you need to make legal determinations just like an attorney about how something like PTO pay in your case translates to what the Department wants reported. And, you need to report hours of work information for many of these wage amounts even if you are paid on a part-time salary basis or a part-time commission of some kind. Finally, all of these numbers need to be reported exactly even though the pay stub that has this information will not be available to you for another week or more.

In light of how the Department has complicated this process immensely, you need to track all the kinds of pay you receive and the hours of work connected with that pay as it happens and not wait until your pay stub arrives. Because your numbers might not agree with your employer’s numbers, you should always round up or increase what you report by a small amount. You will end up receiving less unemployment benefits, but you may avoid a concealment charge.

Note: Given the importance the Department places on getting this kind of reporting correct, you need to start keeping all of your pay stub records automatically. After filing a weekly certification, make it a practice of reviewing those pay stubs and contacting the Department about correcting any weekly claims. Correcting claims with lower numbers will mean you get paid the missing unemployment benefits in future weeks.

To understand how aggressive the Department has become on charging fraud, here are numerous instances where the Department charges fraud that for purposes of unemployment law are NOT actually fraudulent.

- The Commission refuses to accept financial need as a reason for finding a claimant intended to steal unemployment benefits (unemployment benefits are by their very nature intended to address a financial need). Wallenkamp v. Arby’s Restaurants, UI Hearing No. 13607281MW and 13607282MW (15 May 2014), aff’d DWD v. LIRC, 367 Wis.2d 749, 877 N.W.2d 650 (2 February 2016).

- The Commission refuses to find concealment for non-reported wages when claimants subsequently report those wages a few weeks later. Bilton v. H & R Block Eastern Enterprises, Inc., UI Hearing Nos. 13605766MW and 13605682MW (9 Jan. 2014); Perlongo v. Joey’s Seafood & Grill, UI Hearing Nos. 13610060MW & 13610061MW (22 July 2014).

- The Commission continues to find that an October 2012 transformation of a weekly claim certification question into a compound question was confusing and did not warrant a finding of concealment for mistaken claims based on that confusion (beginning in week 43 of 2012, the week ending 27 October 2012, Question No. 4 was modified from “Did you work?” to “During the week, did you work or did you receive or will you receive sick pay, bonus pay or commission?”). Harris v. Arandell Corp., UI Hearing Nos. 13606535MW and 13606536MW (9 Jan. 2014); Henning v. Visiting Angels, UI Hearing Nos. 13606277MW and 13606278MW (9 Jan. 2014); Chao v. Eagle Movers Inc., UI Hearing No. 13607069M and 13607071MW (17 Jan. 2014); Maurer v. Manpower US Inc., UI Hearing No. 13607416MW and 13607417MW (28 Jan. 2014); Wallenkamp v. Arby’s Restaurants, UI Hearing No. 13607281MW and 13607282MW (15 May 2014), aff’d DWD v. LIRC, 367 Wis.2d 749, 877 N.W.2d 650 (2 February 2016); Audwin Short, UI Hearing No. 14600693MW (10 July 2014); Smith v. Journal Sentinel, Inc., UI Hearing Nos. 13610174MW (31 July 2014); Jackson v. Securitas Security Services, Inc., UI Hearing Nos. 14606875MW and 14606876MW (9 June 2015).

- The Commission continues to raise questions about the conduct of administrative law judges who take it upon themselves to chastise claimants for their presumed concealment rather than hearing the evidence as presented and presuming claimant eligibility as the law requires. Henning v. Visiting Angels, UI Hearing Nos. 13606277MW and 13606278MW (9 Jan. 2014); Fera v. South East Cable LLC, UI Hearing Nos. 13607375MW (31 July 2014); Vasquez v. Fedex Smartpost Inc., UI Hearing Nos. 14602073MW and 14602074MW (24 September 2014).

- The Commission continues to find that claimants who are confused about what needs to be reported are just making mistakes and not committing concealment. Hollett v. Douglas Shafler, UI Hearing Nos. 13003690MW and 130003691MW (8 May 2014); Dabo v. Personalized Plus Home Health, UI Hearing No. 14609522MW and 14609523MW (16 April 2015); O’Neill v. Riteway Bus Service Inc., UI Hearing No. 15600518MW and 15600519MW (28 May 2015).

- The Commission continues to find that claimants who are confused about their status as employees or independent contractors are not committing concealment. Haebig v. News Publishing Co. Inc. of Mt. Horeb, UI Hearing Nos. 13000910MD, 13000911MD, and 13000912MD (31 January 2014); David Mumm, UI Hearing No. 13003988MD (28 Feb. 2014); Martin R. Lash, UI Hearing No. 13403269AP (30 May 2014).

- The Commission refuses to give the Department three chances to prove concealment against claimants. Terry v. Jane Schapiro, UI Hearing Nos. 14601971MW and 14601972MW (12 Sept. 2014).

- The Commission refuses to find concealment for claimants who fail to report wages they do not know about when they file the weekly certifications. Bilton v. H&R Block Eastern Enterprises Inc., UI Hearing Nos. 13605766MW and 13605682MW (9 January 2014).

- The Commission refuses to find concealment for claimants who mistakenly report their earnings when received rather than when earned. Waoh-Tobin v. Banana Republic, UI Hearing No. 16602900MW (18 October 2016).

- The Commission even refuses to allow a finding of concealment when there is no information in the record about whether the employee worked any specific weeks, received any wages in those weeks, filed possible claims for those weeks, and then possibly provided information on those non-existent claims that were somehow mistaken from the unknown work and wages allegedly done. Fera v. South East Cable LLC, UI Hearing Nos. 13607375MW (31 July 2014).

When the Department does charge concealment, there are usually two initial determinations making that allegation. The first initial determination will cite the weeks in which the alleged fraud occurred and order repayment of your weekly benefit rate for each week at issue PLUS a 40% administrative penalty (of which the Department itself pockets a portion). The second initial determination will allege a forfeiture of future unemployment benefits (what the Department now calls a benefit amount reduction or BAR) that consists of each week of alleged fraud multiplied by your weekly benefit rate multiplied by a factor of two (the first time you are charged with fraud), four (the second time you are charged with fraud), or eight (the third time you are charged with fraud).

So, a person who fails to report wages for eleven weeks who has a weekly benefit rate of $315 will be hit with the following penalties for that alleged fraud:

$3,465 concealment penalty ($315 X 11)$1,386 administrative penalty (40% of $3465)$7,560 forfieture of future unemployment ($315 X 11 X 2) =$12,411 she needed to repay

These penalties apply no matter the size of the wage discrepancy at issue for the alleged concealment.

In numerous cases, the Department is also now charging fraud when providing mistaken information about a job search (such as registering with the same web site or applying for a job with the same employer within four weeks of each application) or when an employer reports a different reason than you for why there was a job separation (employer reports quit and you report discharge, or you report layoff and the employer reports suspension).

And, fraud is being charged even for wage-reporting mistakes based on future events (an employer receives a PPP loan/grant and then pays you for weeks that you previously claimed months ago in weekly certifications as unpaid because, at the time the certifications were filed, those weeks were unpaid).

Finally, note that, prior to the pandemic, the Department aggressively pursued criminal charges for unemployment concealment against African-Americans and a few others when they did not pay back their concealment penalties quickly enough.

Benefit payments and off-sets

Over-payments occur whenever the Department charges fraud, a claim-filing mistake of almost any kind, or when the Department later determines you were potentially eligible for unemployment benefits in another state or via some other unemployment benefit (like PEUC benefits paid when you should have received regular unemployment benefits because you may have established a new benefit year).

Even before an initial determination is issued, the Department is likely to start issuing over-payment and collection notices.

Carefully review the back of all those notices and see how you can object or appeal them. The distinction is important.

- Objection option: Call a claims specialist at 414-435-7069 within 14 days of the form’s mailing and explain why you think there is an error or that you want the repayment waived because of equity and good conscience (for a federal funded unemployment benefit like PUC or PUA benefits) or departmental error (regular unemployment benefits, EB benefits, or PEUC benefits). If the Department does not accept that the over-payment was issued in error by it, then your objection should trigger the issuance of an initial determination which can then be appealed for a hearing (discussed next)

- Appeal option: File an appeal in writing by stating, “I disagree with the factual or legal conclusions and want any over-payment waived because of equity and good conscience or because of departmental error.” A hearing regarding the over-payment issue will then need to occur.

Once you know the option for fighting that over-payment — objection and then appeal or just appeal, do so. Many of the federal benefits that arise from the CARES Act allow for waiver of non-fraudulent over-payments because of equity and good conscience (i.e., paying back the over-payment is not affordable to the claimant at the moment). It appears that the Department has yet to implement any procedure or process regarding such a waiver for these federal benefits, and so any objection or appeal will be an uphill battle at the moment.

Note: Both PUA and PUC over-payments can be waived because of equity and good conscience. See UIPL 16-20 Change 4 (8 Jan. 2021) at I-25 to I-26 for PUA benefits (state can decide not to waive PUA over-payments, but any waiver must include consideration of equity and good conscience) and UIPL 15-20 Change 1 (9 May 2020) at I-3 for PUC benefits (state can only apply its own waiver standard when that standard requires that the over-payment was the fault of the claimant and such repayment would be contrary to equity and good conscience).

At that hearing, you will argue over whether there is equity and good conscience standard to waive the federally-funded over-payment or departmental error for waiving the regular unemployment benefits over-payment. While the Department so far is ignoring any repayment option for PUC, PUA, and PEUC benefits, the Labor and Industry Review Commission has stated in a recent decision that over-payment waivers because of equity and good conscience do exist for PUC benefits.

Once an over-payment is established, the Department will vigorously pursue collection efforts and not be satisfied simply with off-setting the over-payment against future unemployment benefits. As set forth in the Workers’ Guide, the Department has several debt-collection mechanisms available to it, including garnishment of wages, interception of tax refunds, and even levies of bank accounts. The Department now pursues all of these mechanisms.

Even if you agree with the Department’s decision denying you benefits, an appeal is the ONLY way to get an over-payment waived because of departmental error or equity and good conscience. Given that the $600 PUC paid out during the spring and summer months of 2020 was almost double the maximum weekly benefit rate in Wisconsin, paying back that amount relative to the low wages available in Wisconsin will be incredibly difficult. And, the Department will not relent in seeking to recover that money after your appeal option is gone.

Appealing an initial determination

When explaining why you are appealing an initial determination, all you need to do is say: “I disagree with the factual and legal conclusions.”

If your appeal is late, the standard for allowing that late appeal is incredibly difficult to overcome (you have to show that the appeal is late for reasons beyond your control, so being confused, having a disability, or not understanding legal documents will not excuse a late appeal). The Department presumes you have received all documents mailed to you and that you can call the Department to ask for an explanation of that document. So, you must either accept that you received the initial determination and failed to file a timely appeal for reasons beyond your control (like you could not contact a Department staffer at all) or you must establish that mail delivery to your home was broken in some way — a difficult thing to show, but see Hawthorne v. Triangle Mechanical Inc., UI Hearing No. 09000775MD (8 May 2009) (mail delivery presumed and no evidence available to rebut that presumption), Soto v. Staff Management, UI Hearing No. 03404410AP (14 May 2004) (initial determination mailed while claimant was incarcerated but was not included in the mail that had accumulated in her absence), Schultz v. Mortgage Counselors Inc., UI Hearing No. 99605190MW (24 Nov. 1999) (claimant testified about initial determination delivered after the appeal deadline had expired, and so late appeal allowed).

Once it is shown that you received the initial determination, you must show that you failed to appeal for reasons beyond your control. Being confused or not knowing the law or even not being able to read a document because of a disability are NOT considered valid reasons for a late appeal. But, bad advice from a Department staffer to delay an appeal or to withdraw an appeal generally is considered to be a reason beyond a claimant’s control for a late appeal.

So, when filing a late appeal, you need to provide a detailed explanation for why the initial determination was never received by you, that something happened beyond your ability to control (like getting bad advice from a staffer to not appeal) which led to your appeal being untimely, or both.

Note: It can also be confusing about to whom a late appeal needs to be filed. See the discussion below about petitions for Commission review if you are unsure where to file your late appeal. In general, you file a late appeal when there is only an initial determination. Once an appeal tribunal decision has been issued in some capacity, then a petition for Commission review is necessary.

After filing an appeal, you will receive in the mail an appeal confirmation. If one does not arrive within four to six weeks of your appeal, contact the Department. Prior to the pandemic, appeal confirmations were typically mailed two to five days after the appeal was filed.

As for what to expect at the hearing, the Workers’ Guide to Unemployment Law has excellent advice about how to prepare for your unemployment hearing.

As almost all hearings are now done by phone, you will receive a packet of documents from the hearing office setting forth what the hearing office considers relevant for the hearing. Each page will be labeled at the bottom U1, U2, U3, etc. Go through that packet carefully and make sure you understand all the information in those documents (if you do not understand what a document is or the information it contain, object to that document’s relevancy until an explanation from a witness is provided about what that document is and its information).

If there are documents that should be added for the hearing, make copies of those documents with each page labeled E1, E2, E3, etc., at the bottom and send those copies to the hearing office and any other parties to the hearing along with a cover letter that contains the case name, the hearing number, your name, and a short description of those E-pages. Here is a sample cover letter for employee exhibits.

At present, make sure that any thing you send to the hearing office is done at least two weeks before the hearing occurs, as it still seems that the hearing office needs two weeks to process any paperwork that is sent in.

Note: At the start of a hearing, make sure the administrative law judge has any E-page documents you submitted. If not, immediately ask that the case be “held open and continued” for those missing E-pages.

When the hearing is scheduled, you will receive a hearing notice indicating the date and time for the hearing. Prior to the pandemic, the hearing notice was mailed 6-10 days before the actual hearing date. At present, the hearing notice is being mailed around 10-15 days prior to the hearing date (in other words, the hearing notice is being mailed about 3-5 weeks after the packet is sent).

From the time you file your appeal to when the hearing takes place, three to five or more months seems to be the norm during this pandemic (in Illinois, the waiting period is 2-3 weeks for a hearing after appealing an initial determination). A few cases get scheduled very quickly, but it is also not unusual now for hearings to take six or even more months to occur. Indeed, the delays in getting hearings scheduled have been getting longer during the pandemic. So, expect to wait.

Appeal tribunal decisions — the hearing before an administrative law judge

The administrative law judge will call all the parties and representatives for the hearing. So, make sure your phone is accepting calls when the hearing is scheduled. Likewise, stay off the phone when the hearing is scheduled. And, understand that the administrative law judge may not call immediately at the scheduled start time for the hearing. That call can be up to an hour late, depending on how the hearing schedule that day is going for the administrative law judge.

Have the documents and your notes organized in front of you. During the hearing, take notes of what documents are marked as exhibits and the exhibit number for those documents.

If the administrative law judge says something you do not understand, ask for an explanation or for what was said to be repeated.

Because the Department refers to weeks by numbers and not dates, you should have a DWD calendar with the week numbers listed for examining the weeks at issue in your case. The administrative law judge will likely ask you about some event in week 14, for instance, and you can only know what week 14 is by referring to the relevant Department calendar.

During the hearing, should the administrative law judge ask you about whether a document is “accurate” or “true and correct,” you should almost always say “No.” By asking that question, the administrative law judge is attempting to take a short cut and skip having to ask you any questions and instead to rely solely on what is in the document (because you admitted the document is “accurate” or “true and correct”). Even if all the information in that document is correct, it is seldom complete. As such, you want to say “No, the document is not accurate,” and then go through all the information that needs to be changed or added to the document. In this way, the administrative law judge has to listen to what you say at the hearing about your unemployment claim and not just rely on the Department’s investigation that denied your claim in the first place.

Note: There is no need to apologize or explain about correcting information on an initial claim or weekly certification or some other document. Unless concealment is being charged, you are allowed to update and correct any and all information with your claim. Furthermore, as noted above, the information on these forms may NOT be the actual information you provided.

NEVER agree to anything the administrative law judge asks you unless you know everything in the question to be 100% true, based on your own personal knowledge. Your testimony during the hearing is taken under oath or affirmation, so you must know something personally from your own knowledge and experience to be true if you will testify to it. Never guess or agree to something, even if such agreement makes sense to you or seems harmless. If you do not know a detail, like the date and time you filed a weekly certification, say so. If you know the week or month the weekly certification was filed, agree to that week or month and nothing more.

Administrative law judges in Wisconsin typically ask leading or accusatory questions of claimants, so do not fall into a trap being created for you by agreeing to something because it sounds right. For instance, in a case over PUA benefits because of a quarantine, if you are asked to agree about staying away from work because you were personally worried about Covid-19, answer “no” and explain the actual reason for a quarantine — your doctor or employer told you to quarantine. You may personally think that Covid-19 is dangerous and not want to catch it, but your personal beliefs are irrelevant. What matters is whether your employer or medical provider indicated that you should quarantine.

In other words, listen carefully to each question asked and only agree with the parts of the question that you personally and 100% know to be true and which support your case. If the administrative law judge asks whether you work less hours to make things easier for you, ask what the judge means about “being easier.” Again, DO NOT GUESS at what the judge’s question means. If “easier” means easier in light of your medical restrictions and disability, then “yes, working only the 15 hours a week your doctor has specified is easier.” If easier means that you prefer to work less given your hectic schedule and a desire to relax some, say “no.” When framed in this way, answering “yes” would disqualify you from receiving unemployment benefits.

Finally, never presume that Department records accurately reflect anything. Certain Department records often change based on what Department staffers do with a claim. So, information that might appear in a record can disappear or be changed based on what a Department staffer does in processing that claim, including dates, names, and findings. So, if you understand something to be different from what is on the Department form, you are probably right and stick to what you know to be true rather than accept what the Department proffers in its form.

Again, if a Department form does not have all the information relevant to your unemployment claim, that form is NOT accurate even if that form reflects what you filled out at the time. Make sure to add all information your think is relevant in your testimony, as this hearing is the ONLY chance you may have to present your case.

After the hearing is over, the administrative law judge will issue a decision, called an appeal tribunal decision. These decisions are generally NOT available on the Department’s UI portal, as they are only mailed to you.

Carefully review the decision. The cover or first page is generated when the administrative law judge enters his or her decision into the Department’s computer systems.

This cover page will state whether the decision is affirmed or reversed or modified in some way (such as reversed in part and affirmed in part). The bottom of the cover page will indicate the date of the decision and when an appeal needs to be filed before the decision is final. The back of the cover page will explain how to petition for Commission review or obtain a recording of the hearing and is the same back page in every appeal tribunal decision.

The rest of the decision will be what the administrative law judge actually wrote in deciding your case. It will include a summary of the initial determination, factual findings, a discussion of the relevant law to your case and how that law applies to the facts as found by the administrative law judge, a legal conclusion (usually you are eligible or are NOT eligible pursuant to a provision of unemployment law), and a decision section that repeats the legal conclusion.

Given the number of hearings now going on, numerous errors are appearing in these appeal tribunal decisions. Sometimes the administrative law judge writes in her or his decision that the initial determination is reversed, but the cover page says that the initial determination is affirmed. Sometimes, the weeks at issue are wrong (a decision may have you qualified for benefits as of week 14 but later disqualified for benefits as of week 14, or qualified as of week 14 and then qualified later in the decision at week 18).

All of these errors can lead to benefits being denied even if the decision in general approves of your eligibility. And, these errors will certainly lead to payment of benefits being delayed.

So, if you see such an error in your appeal tribunal decision, call the hearing office as soon as you can and explain to staff you see such an error. As hearing office staff seem to no longer have access to appeal tribunal decisions, you may need to read portions of the decision to the staffer. Ask that the error be brought to the attention of the administrative law judge so that an amended decision correcting the error can be issued.

If a corrected decision is NOT issued by the appeal deadline for Commission review, you need to make a choice about whether to appeal the decision for Commission review to get the error corrected that way or hope that the Department will itself correct the error at some later point in time.

(Update 15 March 2021) If you win your case before the administrative law judge, do NOT expect a payment any time soon. Right now, payment after winning an unemployment hearing is taking four weeks (the quickest I have seen) to six to ten weeks on average.

Once payment is received, immediately get a PDF of your benefit payment history to determine which weeks are actually paid and how much is paid per week. If unsure about how to get this document, follow these directions.

Commission decisions — petition for Commission review

At the end of the Workers’ Guide there is an explanation for how to appeal a decision of an administrative law judge to the Labor and Industry Review Commission — what is called a petition for Commission review.

While filing that petition, you either provide an explanation for why the appeal tribunal decision is legally or factually wrong as part of your petition or you request a briefing schedule when the hearing synopsis is complete (while also requesting a copy of that hearing synopsis).

- When filing a petition and NOT requesting a briefing schedule, you provide your legal and factual argument about why the appeal tribunal decision is wrong as part of your petition.

- When requesting a briefing schedule, you simply state, “I disagree with the appeal tribunal decision and request a briefing schedule when the hearing synopsis is complete and mailed to me.” You provide your legal and factual argument in a legal brief to the Commission after you receive and review the hearing synopsis. The time line for submitting the brief is usually fifteen days from when the synopsis is mailed to you.

There is no hearing before the Commission. The Commission reviews the hearing synopsis and hearing exhibits and any arguments you submit with your petition or (having requested a briefing schedule) in your legal brief.

If the issue in question is a late appeal because of bad advice from a Department staffer, it can be confusing about where to file that late appeal. The Department’s UI portal, for instance, only allows you to file a late appeal of an initial determination for several weeks after the initial determination is issued. After six or so weeks, the ability to appeal an initial determination on the portal “disappears.” To file an appeal in these circumstances, you need to write a letter to the Hearing Office listing the initial determination number you are appealing, your name and mailing address and last four digits of your social security number, any employer listed on the initial determination, a statement that you disagree with the factual and legal conclusions of the initial determination, and an explanation (see above for what information that explanation should contain) for why your appeal is late.

Only if you previously appealed that initial determination, then withdrew that appeal (probably because of bad advice from a Department staffer), so that an appeal tribunal decision was issued for that withdrawal, and the time period for retracting that withdrawal has expired do you then file a petition with the Commission. In short, the Commission only has jurisdiction of cases that have a hearing number attached to them.

Commission decisions typically take a month or two. With the pandemic, that review is now usually several months, and some cases can take much longer.