(Update: 2 April 2024): Gov. Evers vetoed AB398.

I am vetoing Assembly Bill 398 in its entirety.

This bill specifies that compensated participants in clinical research trials shall not be treated as employees for purposes of minimum wage, worker’s compensation, and unemployment insurance laws.

I am vetoing this bill in its entirety because I object to potentially depriving clinical research trial participants from receiving the protections and benefits to which employees are generally entitled, as well as related legal remedies. Additionally, the changes in this bill create a specific carveout from provisions that could otherwise classify an independent contractor as an employee for purposes of worker’s compensation protections. There continues to be a well-established process that the Department of Workforce Development uses to navigate employee and contractor determinations on a case-by-case basis. The department uses a six-part test for minimum wage, and a nine-part test for unemployment insurance and worker’s compensation benefits. These tests provide a guideline and consistency for classification between the relationships of individuals and employers.

I object to providing a specific carveout for clinical research trials, which may signal to other employers that they may seek similar special treatment for other work or services that would otherwise qualify for worker’s compensation benefits under the law, which may further limit employee protections.

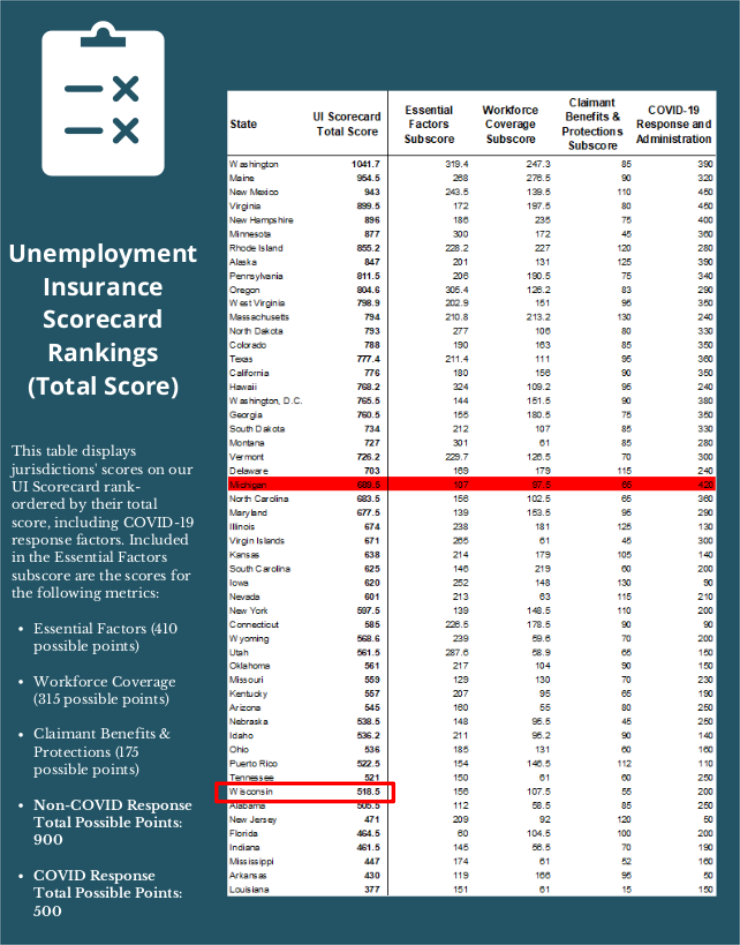

Moreover, I am concerned this bill may cause Wisconsin to fail to conform with federal requirements. Specifically, it could put Wisconsin in nonconformity with the Federal Unemployment Tax Act which may put employer tax credits and Unemployment Insurance administrative grant dollars at risk of terminating.

Finally, neither the Worker’s Compensation Advisory Council nor the Unemployment Insurance Advisory Council has taken a position on the changes in the bill, and these councils should be key stakeholders for recommending such policy changes for enactment.

As evident here, Gov. Evers largely accepts what the Department is proclaiming about this bill. The problem here is that no one but the Department thinks that people involved in lab testing are employees. Does Gov. Evers really think that my daughters, when they participated in UW-Madison College of Education experiments about teaching math, were employees of UW-Madison because of their participation in those experiments? That is the position Gov. Evers has adopted here.

This bill is needed to correct what the Department is doing. The bill, however, needs to be amended, as indicated below, so that it actually accomplishes what it sets out to do.

Update (21 March 2024): I have asked Gov. Evers to veto AB398, which the legislature has sent to the Governor.

Update (23 Feb. 2024): There has been legislative action on the assembly companion bill, AB398, as the Assembly has passed this bill and sent it to the Senate for action.

I would encourage passage IF the bill was amended to actually exclude lab tests subjects as employees in unemployment law. For example: an amendment to the definition of employees in Wis. Stat. § 108.02(12) to exclude from the definition of employee an “individual who receives remuneration, a stipend, or 6compensation for being a participant in a clinical research trial as described in s.108.02 (15) (ko).” This exact provision is included in the proposed change to workers compensation law, and so there is no reason why it should not be applied in unemployment law.

In late 2022 and early 2023, a few folks started contacting me about being disqualified or having to repay unemployment benefits they received during the Covid-19 pandemic because of their participation in lab testing studies.

Then at the July 2023 Unemployment Insurance Advisory Council meeting, a coalition of lab testing companies and Rep. Gundrum asked the council to support a change in the law to exempt lab testing as covered employment. According to the minutes of that meeting:

State Representative Rick Gundrum addressed the Council regarding a proposed bill to clarify the employment status of participants in clinical research trials. Rep. Gundrum stated that participants in clinical research trials are volunteers and are not employees of the research organization. Participants receive a stipend for their participation. Rep. Gundrum stated that a clinical trial lasts between three and six months, with the typical participant’s length of stay at the research facility being three to four days. Rep. Gundrum stated that he has heard that DWD considers research trial participants to be employees. Rep. Gundrum stated that the research companies cannot enroll their own employees as participants.

Rep. Gundrum stated that that the draft of LRB 1462 seeks to clarify the relationship between participants and research companies. Under the proposed bill, participants would not be considered employees for purposes of Unemployment Insurance, Workers Compensation, and minimum wage. Rep. Gundrum stated that research organizations in Wisconsin are at a competitive disadvantage with similar firms in other states. The new bill addresses federal conformity issues raised by the Department in last session’s version of the bill.

Ms. Knutson stated that a copy of the LRB Draft is included in members’ packets.

Mr. Manley asked if a participant who is laid off and collecting UI benefits would lose their benefits.

Representative Gundrum stated that he does not think that participants would lose their benefits but will check further and get back to the Council.

Ms. Knutson stated she would check with staff to determine if the stipends would be considered reportable wages.

At the September 2023 Advisory Council meeting, SB387 was introduced to council members along with the Department’s fiscal estimate.

This bill proposes that a participant in a clinical trial is not an employee for purposes of state wage law and workers’ compensation law and is not in covered employment for purposes of state unemployment law. The Department’s fiscal estimate mostly indicates that the financial effects of the bill are indeterminate (other than an annual loss of $2.8 million in unemployment tax revenue to the unemployment trust fund).

This fiscal estimate also indicates that clinical lab companies would lose their FUTA tax credits because those companies would no longer be in compliance with federal unemployment law, unless those companies voluntarily agreed to have their clinical subjects listed as their employees for purposes of unemployment eligibility (and so, undoing the purpose of this proposed law).

As for unemployment purposes, this bill only addresses half of the problem — covered employment — and ignores the issue of employee status. As I wrote in an e-mail message to Rep. Gundrum in Sept. 2023:

I don’t think think SB387 will work as currently drafted. While it excludes employment for UI purposes, it does not address employee or wage coverage. Per the definitions of wages and employee in 108.02, a person qualifies for UI coverage if he/she performs services for pay for an employer/employing unit.

So, even if there is no employment, these lab volunteers will still have to report their wages and any separations to DWD-UI for these lab experiments. So, while the employer may no longer be paying UI taxes for their lab volunteers, the employers will still have to answer questions about all of their lab volunteers and still report all of these employee issues and wages for anyone who is claiming UI at the time of these experiments.

That is, for this proposal to exclude lab participants in all unemployment matters, the exclusion needs to be in both covered employment and in whether laboratory participants still qualify as employees for purposes of unemployment law.

Note: the definition of employee in Wis. Stat. § 108.02(12)(a) is expansive and applies to any person who performs services for pay for another. So, a lack of covered employment does not mean that unemployment is not involved. See Piontek v. Cooper Spransy Realty Inc, UI Hearing No. 09003831MD (17 March 2010), aff’d Piontek v. LIRC, 340 Wis.2d 742, 813 N.W.2d 248 (app. Ct. 2012) (a realty agent’s decision to transfer brokerages — i.e., quit one brokerage — disqualified him from receiving unemployment benefits because of his prior layoff from a factory as he was also an employee of the brokerage despite his realty services to that brokerage being in excluded employment).

I also had questions about the $2.8 million in unemployment tax revenues and the FUTA tax coverage problem mentioned in this fiscal estimate. Federal unemployment law does not really address this issue/problem of FUTA tax coverage, and I suggested that specific directive/advice from Region 5 of US Dep’t of Labor on this loss of FUTA tax credits question be sought out.

And, the $2.8 million figure in annual unemployment tax revenue seems much too large and is somewhat unbelievable. Understand that unemployment taxes only apply to the first $14,000 paid to an “employee.” So, a tax payment of $1000 per “employee” would be an extremely high 14% tax rate (for comparison, the highest tax rate applicable in the current Schedule D tax schedule is 12%, and the new employer tax rate for a large business in that schedule is 3.25%).

But, using that $1000 in unemployment taxes per employee figure would mean that clinical lab companies have 2,800 clinical lab “employees” for which unemployment taxes are being paid. The November 2023 jobs report for Wisconsin has all of 416,900 employees in health care and social assistance in the entire state (every hospital, doctor’s office, social worker, and other health-related employee). Using a 3.25% tax rate to get $455 in unemployment tax revenue means that there are nearly 6,200 clinical research subjects in Wisconsin based on the Department’s $2.8 million figure. And, a likely tax rate of 1.05% (for $147 in revenue per “employee”) means there are just over 19,000 participants in lab tests in Wisconsin.

All three of these numbers of clinical research subjects would make them a major job sector of the state economy. Maybe there are a few hundred clinical lab test volunteers every year in Wisconsin. But, are there 2,800 let alone 19,000 such volunteers every year? Given that laboratory research has never been seen as an economic engine in the state’s economy, something is off with the Department’s $2.8 million annual tax revenue figure.

Finally, this whole issue turns on the Department treating participants in lab tests as employees because they are allegedly performing services for pay for another. But, the Department also has explicit guidance that payments for blood and plasma donations do NOT qualify as income. I have yet to see any explanation from the Department that explains how a payment for blood in general is not income but a payment for blood for a laboratory test does count as income for unemployment purposes.

A hearing on AB398, a companion bill to SB387 is scheduled for January 10th before the Assembly Committee on Health, Aging and Long-Term Care. Here is hoping that some of these issues can be ironed out and some real change made with this bill.