The official Advisory Council/DWD bill, AB819, had its first public hearing on Thursday, February 4th, before the Assembly Committee on Jobs and the Economy.

The Department of Workforce Development and the Advisory Council presented testimony in support of this bill. The Labor and Industry Review Commission testified against sections 54 and 55 of the bill — Department proposal D15-11, previously described here and here. I cannot think of any instance in which one state agency testified against a bill supported by another state agency. To understand the nature of this dispute, see the Commission’s memorandum and the Department’s responses to that memorandum.

I also testified about the proposed concealment changes in the bill.

On February 10th, the Senate Committee on Labor and Government Reform held its hearing on the Senate version of the Department’s UI bill, SB684. WisEye was there.

The Department and the Advisory Council again pushed for adoption of these proposed changes, and the Commission again disputed the changes to circuit court review. Both Kevin Magee from Legal Action of Wisconsin and myself testified against the proposed concealment and “program integrity” changes.

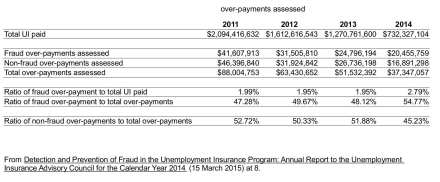

My testimony focused on the Department’s marked increase in concealment cases starting in 2014 and even more concealment cases in 2015 against Wisconsinites. To demonstrate this concealment expansion, I used two charts. The first chart looked at how concealment assessments have varied from 2011 through 2014.

In this chart, the percentage of concealment assessments relative to the unemployment benefits being paid out was pretty much constant from 2011 through 2013. In 2014, however, concealment over-payments as a percentage of total unemployment benefits paid out jumped to 2.79%, approximately a 0.80% increase from the previous year. A 0.8% in gross domestic product or the unemployment rate would make headlines across the state. So, this 2014 increase in concealment over-payments being charged against claimants is remarkable.

These numbers from the fraud report also show how concealment over-payments suddenly increased in 2014 relative to non-fraud over-payments. In 2011, 2012, and 2013, non-fraud over-payments constituted more than 50% of total over-payments. In 2014, however, non-fraud over-payments dropped over five percentage points to just over 45%. Naturally, the percentage of fraud over-payments to total over-payments jumped in 2014 to nearly 55%. So, in 2014 concealment shot up in scope relative to unemployment in general just as non-fraud over-payments markedly declined.

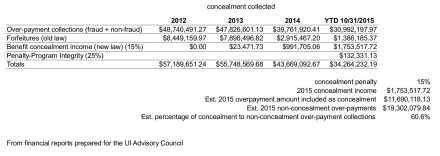

Over-payment assessment data for 2015 is not yet available. But, the financial reports prepared for the Advisory Council indicate how much concealment monies have been collected by the Department as of 31 October 2015. As of that date, the Department had collected nearly $31 million in fraud and non-fraud over-payments. Of this amount, just over $1.753 million had been collected pursuant to the 15% concealment penalty that applies in concealment cases.

This 15% number provides a mechanism for estimating how much of the $31 million in over-payments relate to concealment allegations in general. Dividing $1.753 million by 15% equals approximately $11.69 million and represents the over-payments so far arising from concealment. Subtracting $11.69 million leaves around $19 million as the non-fraud portion of the over-payments paid in 2015. Accordingly, by 31 October 2015 the percentage of concealment to non-concealment over-payments collected at nearly 61%.

These numbers show a sudden increase in 2014 in concealment cases and this increase accelerated in 2015. In this light, the Department’s push to change the definition of concealment is part of an agenda to expand the scope and reach of concealment. The Department countered in its testimony before the committee that an intent to conceal is still required under its proposed changes to the definition of concealment. The proposed language, numerous posts on this blog, a Commission memorandum, and Kevin Magee’s testimony at the public hearing belie the Department’s assertions. Mistakes are increasingly being charged as concealment by the Department, and Commission review applying the actual concealment standard is the only way to fight these kind of charges.

Essentially, concealment is becoming the modus operandi of the Department’s efforts in administering the state’s unemployment law. Anyone who makes a mistake is at risk of a concealment charge from the Department, and the Department wants to change unemployment law to reflect this practice.

Pingback: The declining market for unemployment benefits | Wisconsin Unemployment

Pingback: Criminalization and strict liability for concealment: moving forward | Wisconsin Unemployment

Pingback: Update on UI legislation | Wisconsin Unemployment

Pingback: Concealment charges and collections | Wisconsin Unemployment

Pingback: The profit in unemployment concealment | Wisconsin Unemployment

Pingback: The original 2012 SSDI ban reemerges in Evers’ 2021 budget proposal | Wisconsin Unemployment